Table of Content

Comparison rates for variable Interest Only loans are based on an initial 5-year Interest Only period. Comparison rates for fixed or guaranteed Interest Only loans are based on an initial Interest Only period equal in length to the fixed or guaranteed period. 2Rate/s apply to new lending only and may include a margin below or above the applicable reference rate.

You will pay $233,133.89 in interest over the course of the loan. If you pay an additional $50 per month, you will save $21,298.29 in interest over the life of the loan and pay off your loan two years and four months sooner than you would have. Loan and age eligibility requirements and other limitations and exclusions may apply. But what if there was a way to reduce the length of your home loan, and save on interest? By making an extra lump sum payment off your loan, you can.

Rate hikes spike interest in fixed rate mortgages

The average home loan can span anywhere from 25 to 30 years - this is a big commitment! It’s also a long time to be making repayments and incurring interest, which is why reducing the life of your home loan is a helpful way to save money. Enter your loan details into the calculator and the difference between the normal repayments and the amount you can afford to repay into the extra contribution section. Find out how much time and interest you can save by paying more than your minimum repayments. This mortgage repayment calculator lets you calculate these savings based on different repayment amounts over various terms. You can choose to make your Principal and Interest home loan repayments monthly, fortnightly or weekly.

Let's take a look at an example of how much extra payments can save on a loan of $150,000 with an interest rate of 5.5% and a 10-year term. But remember, some loans don’t allow you to make additional repayments or have limits on the extra repayments you can make. Reduce Home Loans offers fixed loans with extra repayments available up to $20,000 per anniversary year during the fixed period. After the fixed period expires, the rate reverts to variable and unlimited extra repayments and redraw apply. The amount you can save with extra home loan repayments depends on your home loan size, loan term and interest rate. Use the above mortgage over-payment calculator to determine your potential savings by making extra payments toward your mortgage.

NSW Stamp Duty Calculator 2022: Property Transfer Duty

If you’re considering making $300 extra monthly repayments, but the penalty is $350, you might decide it isn’t worth it for you. You could consider refinancing and switching to a home loan without extra repayment penalties, but this will come down to your own individual circumstances. Making extra repayments is a great way to pay off your mortgage sooner. Even small, frequent additional repayments can have a huge impact. Some home loans, generally fixed, allow you make extra repayments up to a certain amount and others, generally variable, allow you to make unlimited repayments. If you are disciplined with your money then it is better to make those extra payments to your offset account.

Alternatively, you can reduce your repayments to free up some cash, provided we’ve reduced the interest rate or you’ve gotten ahead on your loan by making additional repayments. This calculator allows you to enter an initial lump-sum extra payment along with extra monthly payments which coincide with your regular monthly payments. We also offer three other options you can consider for other additional payment scenarios. Making repayments above your minimums could make a big difference to how quickly you could pay off your home loan.

See all home loan interest rates

This is because there are 26 fortnights in a year, which breaks down to the equivalent of 13 monthly repayments. It is possible to cut your loan term straight down the middle, but it depends on how much and how frequently you’re able to contribute towards extra payments. While most mortgages are set to monthly repayment frequencies, you could adjust the repayment cycle to weekly or fortnightly. Considering that interest is charged daily, making more frequent repayments can reduce the interest paid overall. Despite these benefits, it’s important to note the drawbacks of making extra payments. Most notably, lookout for a ‘break fee’, which is generally only charged if you pay down your fixed-rate home loan earlier than expected.

To also run scenarios for new payments by changing the loan term try Loan Repayment Calculator. To find out more about how an offset account works or to calculate your average offset balance please see our offset account calculator page. Applications are subject to credit approval, satisfactory security and minimum deposit requirements. Full terms and conditions will be set out in our loan offer, if an offer is made. With an offset account attached to your loan, you can reduce the amount of interest you pay.

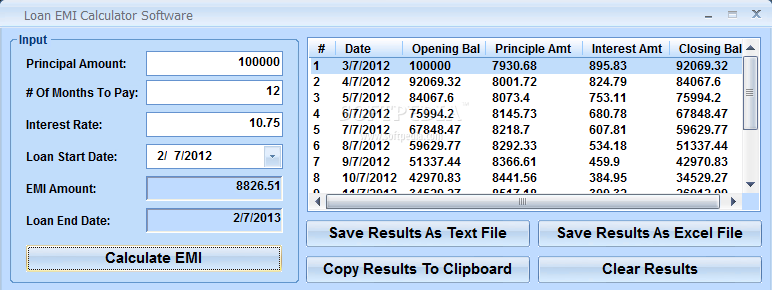

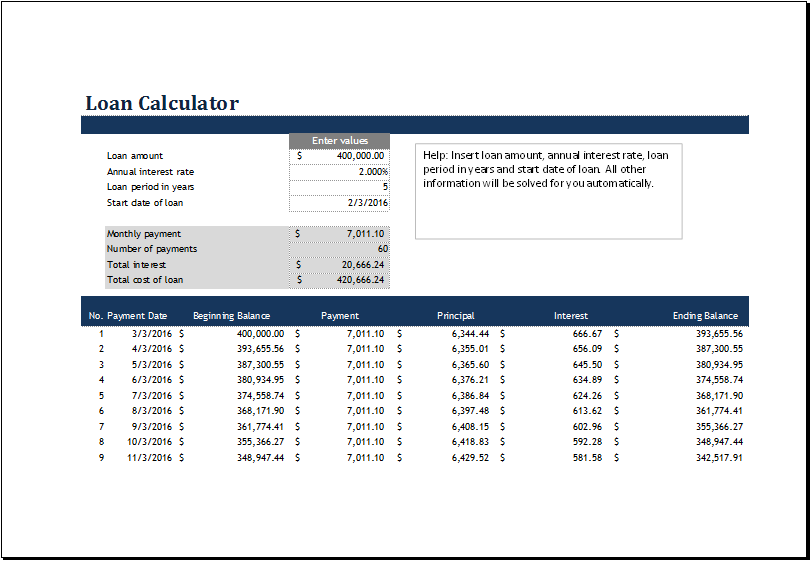

Loan Calculator With Extra Payment

Offering a change of pace from Australia’s mecca, the sun, sand and surf offered by the Central Coast remain an enticing... Australia’s most prolific property market bore the brunt of declines in 2022, yet opportunities remain in the following ... Often considered the ‘little brother’ to capital city markets, regional property markets have held up stronger throughou... Try our personal budget calculator to help plan your weekly expenses. Our award-winning mortgage brokers will find you the right home loan for your needs.

There are a few factors that determine how quickly you can pay off your mortgage – your loan size, your loan term, your interest rate and your loan features. If you want to pay your home loan debt sooner, you may want to consider choosing a loan that allows for extra repayments without penalty. Making extra payments is one of the easiest ways to get on top of your debt quicker than your loan term. The main benefit of paying extra on a home mortgage or personal loan is saving money. When a borrower consistently makes additional payments, he could save thousands of dollars on his loan.

You're refinancing a residential property for up to 80% of its current value. I had a fantastic experience dealing with Reduce Home Loans who provided finance for my SMSF to purchase an investment property in July 22. I was particularly impressed with Bryce Stimpson's helpfulness, knowledge, responsiveness, professionalism and pleasantness.

Whether you’re buying your first home, next home or an investment property, we’ve got a range of home loans to help you get there. Eligible customers will receive $2,000 cashback transferred electronically into their new home loan account. Should you take out a home loan with Unloan, discounts applied during the life of the loan will be applied to the relevant reference rate at that time. No matter what stage of the home loan journey you’re at, we’re here to help you find a great rate across variable, fixed or a mix of both. This calculator helps you determine your maximum borrowing power. Find out how much stamp duty you’ll pay based on your state and purchase price.

Compare rates, features and fees across all our home loans in this easy table. If your circumstances do change, and you think you’ll find it difficult to meet your required repayments, we can help. You might also want to consider aligning your repayment date to a few days after you get paid to avoid missing repayments.

I received an excellent rate and am happy I went with Reduce. To switch in the CommBank App, tap 'View accounts' then choose your home loan. Tap 'Manage loan' and then 'Change to Principal & Interest / Interest only'.

During an Interest Only period, your Interest Only payments won't reduce your loan balance unless you choose to make additional repayments. At the end of an Interest Only period, your repayments will increase to cover Principal and Interest components. Again, this will depend on how often you make additional repayments, and how large the repayment amounts are. You're looking for a low variable rate home loan, with redraw. You don't require an offset account, fixed rates or interest-only repayments.

For the Rate Buster Variable where the borrower pays an upfront fee of $150 then a corresponding loyalty discount of 0.05% p.a. Off the Rate Buster Variable rate will automatically apply after the 5th anniversary of the loan. For the Investor Rate Buster Variable where the borrower pays an upfront fee of $697 then a corresponding loyalty discount of 0.08% p.a.

No comments:

Post a Comment