Table of Content

This could make it easier to stay on track with other large outgoings you may have. Understanding repayments and how to best manage them can help you make the most of your home loan. By default 30-yr fixed-rate loans are displayed in the table below. Filters enable you to change the loan amount, duration, or loan type. Applications for finance are subject to the Bank's normal credit approval.

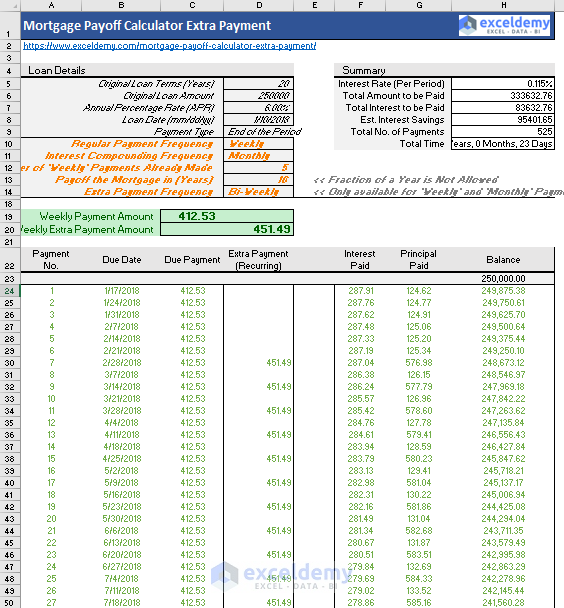

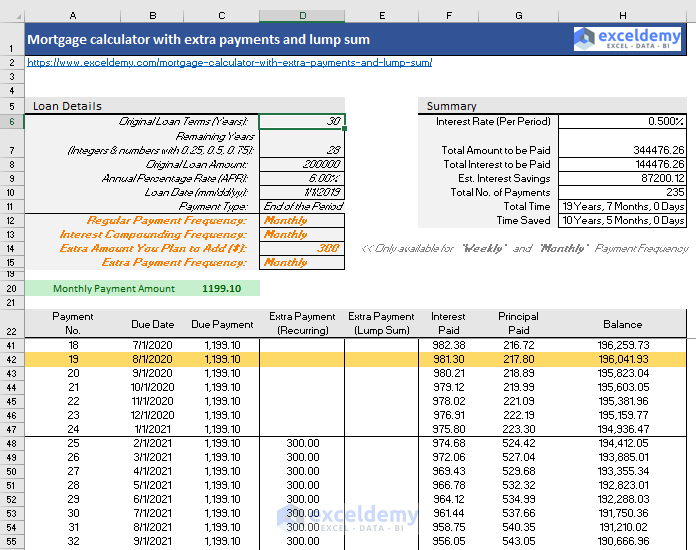

To help you understand how extra and lump sum payments can impact the total amount you will need to repay on your home loan, here is an example provided by the calculator. Making even small extra repayments to your loan can make a big difference to the length of your loan. Just $10 extra a week could mean three or four less home loan repayments, saving you thousands. If you’ve saved a lump sum you want to put towards your home loan amount, you can also use the Offset Calculator as an extra repayment and lump sum calculator. Instead of paying twice a week, you can achieve the same results by adding 1/12th of your mortgage payment to your monthly payment. Over the course of the year, you will have paid the additional month.

Compare home loans

Comparison rates for variable Interest Only loans are based on an initial 5-year Interest Only period. Comparison rates for fixed or guaranteed Interest Only loans are based on an initial Interest Only period equal in length to the fixed or guaranteed period. 2Rate/s apply to new lending only and may include a margin below or above the applicable reference rate.

If you’re considering making $300 extra monthly repayments, but the penalty is $350, you might decide it isn’t worth it for you. You could consider refinancing and switching to a home loan without extra repayment penalties, but this will come down to your own individual circumstances. Making extra repayments is a great way to pay off your mortgage sooner. Even small, frequent additional repayments can have a huge impact. Some home loans, generally fixed, allow you make extra repayments up to a certain amount and others, generally variable, allow you to make unlimited repayments. If you are disciplined with your money then it is better to make those extra payments to your offset account.

Mortgage Brokers

It cannot be established in the name of a business or family investment trust. Trust loans can however be linked to the trustee package where the trustee is an applicant (i.e. the borrower) on the loan. For example, a loan held in the name of “John Smith ITF The Smith Family Trust” can have a package established in the name of John Smith as the trustee. Estimate the other costs of buying a property, including government costs, stamp duty, and fees. Digital lender Athena has altered its variable home loan products, launching ‘Straight Up’ and ‘Power Up’ home loans.

This will enable you to access the funds in the future with greater ease. Of course if you access the funds you have paid into your offset account then you will lose the benefit from making your additional repayments. Yes, making additional repayments to a 100% offset account will have the same effect as if you had made the extra repayments to your loan account.

Home loan repayments calculator

Put in any amount that you want, from $10 to $1,000, to find out what you can save over the life of your loan. The results can help you weigh your financial options to see if paying down your mortgage will have the most benefits or if you should focus your efforts on other investment options. As you nearly complete your mortgage payments early be sure to check if your loan has a prepayment penalty. If it does, you may want to leave a small balance until the prepayment penalty period expires.

The current reference rates including for Interest Only payments can be found here. Apply by 31 December 2023 and have your loan funded by 31 March 2024. Not available for Bridging Loans or Construction Loans. Limit of one refinance-in cashback per borrowing entity and per customer over a 12 month period. Compare home loan options and adjust variables like interest rates and loan term.

Want to discuss your home loan needs? We’re here to help.

For the Rate Buster Variable where the borrower pays an upfront fee of $150 then a corresponding loyalty discount of 0.05% p.a. Off the Rate Buster Variable rate will automatically apply after the 5th anniversary of the loan. For the Investor Rate Buster Variable where the borrower pays an upfront fee of $697 then a corresponding loyalty discount of 0.08% p.a.

I received an excellent rate and am happy I went with Reduce. To switch in the CommBank App, tap 'View accounts' then choose your home loan. Tap 'Manage loan' and then 'Change to Principal & Interest / Interest only'.

Off the Investor Rate Buster Variable rate will automatically apply after the 5th anniversary of the loan. For the Investor Rate Lovers Interest Only where the borrower pays an upfront fee of $697 then a corresponding loyalty discount of 0.07% p.a. Off the Investor Rate Lovers Interest Only rate will automatically apply after the 5th anniversary of the loan. For the Investor Rate Slasher where the borrower pays an upfront fee of $1,170 then a corresponding loyalty discount of 0.09% p.a. Off the Investor Rate Slasher rate will automatically apply after the 5th anniversary of the loan. For the Cash Back Hero Variable where the borrower pays an upfront fee of $697 then a corresponding loyalty discount of 0.08% p.a.

You’ll be able to view your new monthly repayment amount, the projected total loan repayments and savings in interest and time, as well as an updated total loan term. You can save thousands in monthly repayments and take years off your loan by making extra repayments. Use this free calculator to see how even small extra payments will save you years of payments and thousands of Dollars of additional interest cost.

Off the Economizer Variable will automatically apply after the 5th anniversary of the loan. For the Super Saver Variable where the borrower pays an upfront fee of $1170 then a corresponding loyalty discount of 0.15% p.a. Off the Super Saver Variable will automatically apply after the 5th anniversary of the loan. For the Super Saver Cash Back Variable where the borrower pays an upfront fee of $697 then a corresponding loyalty discount of 0.10% p.a.

Calculate your borrowing power and what your repayments might be. Principal and interest repayments means your regular home loan repayments pay down both the amount you’ve borrowed and the interest you’ve accrued. Use our calculator to get an idea of what your mortgage repayments might be.

Offering a change of pace from Australia’s mecca, the sun, sand and surf offered by the Central Coast remain an enticing... Australia’s most prolific property market bore the brunt of declines in 2022, yet opportunities remain in the following ... Often considered the ‘little brother’ to capital city markets, regional property markets have held up stronger throughou... Try our personal budget calculator to help plan your weekly expenses. Our award-winning mortgage brokers will find you the right home loan for your needs.

No comments:

Post a Comment